When clients approach us for help with their heritage regeneration project, we don’t see our role primarily as “cash chasers”. Especially in the early stages of the journey, the focus should instead be on developing programmes on which the fundraising will eventually be based; in other words, the programmes that will make the client ‘fundable’. We are also frequently asked to assess the feasibility of a particular funding proposition or to mentor / coach leadership teams. This early case development work is essential as it ‘prepares the ground’ on which a successful campaign will be built.

Craigmyle consultants can look back on a successful 1st quarter of the year, securing necessary funds and helping clients develop their heritage projects.

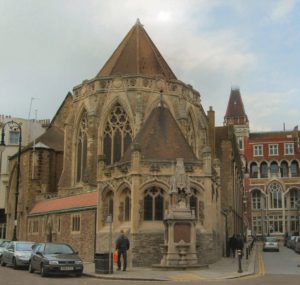

We have been working with Christ Church St Leonards towards securing a £250,000 grant from the Lottery. The grant, awarded in January, will cover the restoration of the exterior of the church and the development of live demonstrations and interpretation projects focussing on the key heritage assets of the church and a ‘heritage hub’ from which community activities will be developed and run. Previously Craigmyle successfully applied for two major grants for Christ Church from the Historic England’s Cultural Recovery Fund for Heritage, totalling £280,000.

The Friends of Nunhead Cemetery in partnership with Southwark Council secured the £250,000 match funding as part of the development phase of their £4,2m Heritage Lottery bid. The client plans to restore a Victorian Gate Lodge at the cemetery’s entrance (currently a ruin) and turn it into a community hub plus café. The cemetery is one of the ‘Magnificent Seven’ Victorian cemeteries established in London between 1832 and 1841. The ecological significance of the cemetery’s is reflected in its status as local Nature Reserve and Metropolitan Site of Importance for Nature Conservation. The project’s wide-ranging volunteering opportunities and activity plans will benefit local communities in this multi-cultural part of South London. Our consultants were given just six months to find £250,000 and managed it with grants from Historic England, Pilgrim Trust and Garfield Weston Foundation as well as Section 106 funding.

Another Craigmyle client, the PCC of St John’s Deptford secured a £62,054 grant from NLHF to restore their Grade II* Historic Organ, built in 1901. Community activities around the restoration are designed to boost engagement with heritage, support wellbeing, build skills and employability within this young, diverse, multi-ethnic community. Black and other ethnic minorities constitute 95% of St John’s congregation and c.55% of regular users, including asylum seekers and refugee households who use a foodbank on church premises. Upon completion, the organ will be comprehensively recorded and made into a publicly available ‘digital virtual pipe organ’.

Since 2022, consultants have been working with Holy Trinity Hastings, to develop and secure funding for their £4.5m ‘Heritage@HTH project. The project aims to restore the exterior and interior of the Grade II* listed church building, including the restoration of church treasures that are of national and international heritage significance. Alongside energy efficiency/ sustainability measures, these plans also aim to create a new curated Heritage Experience for Hastings including multi-media interpretation content developed by students at the local College for Further Education. The client was able to secure seed-funding from the local Heritage Action Zone funding body, which allowed them to develop a project that is more ambitious than anything they have ever done before. In December 2023, HTH Church received initial support from The National Lottery Heritage Fund to fully develop their plans and to apply for a full National Lottery grant at a later date. Craigmyle will continue be an integral part of this next important phase of the project.

Finally, Autism Together, a large autism care provider based in the Wirral, secured a £10,000 Project Viability Grant from the Architectural Heritage Fund which allowed them to engage a team of architects to carry out an options appraisal for the future use of the heritage buildings they own. The buildings are set in an area with a fascinating 19th century industrial heritage story. This will be an exciting journey for Autism Together involving local heritage partners and community groups and Craigmyle will be alongside Autism Together every step of the way.

Email us at first@craigmyle.org.uk

Twitter: https://twitter.com/craigmylefr

Linkedin: https://www.linkedin.com/company/craigmyle-&-co-ltd

We are delighted to announce that as of November 2023 Aaron Barbour has joined the Craigmyle consultant team.

Aaron has over 26 years’ experience as a seasoned and successful fundraiser and charity leader. Aaron has experience in a wide range of fundraising, specialising in Trusts and Foundations and the Lottery; as well as corporate fundraising, sponsorship, community fundraising, government (central and local – contracts and grants), major donors, individual giving, online fundraising and match giving campaigns e.g. the Big Give.

Aaron has over 26 years’ experience as a seasoned and successful fundraiser and charity leader. Aaron has experience in a wide range of fundraising, specialising in Trusts and Foundations and the Lottery; as well as corporate fundraising, sponsorship, community fundraising, government (central and local – contracts and grants), major donors, individual giving, online fundraising and match giving campaigns e.g. the Big Give.

In addition to fundraising, Aaron has spent the last 17 years in senior leadership roles as CEO, Chair of Trustees and Trustee, for small and local charities (some start-ups and some well-established). His experience includes strategic development, project management, partnerships, trustee governance and leadership development, as well as feasibility studies, case development, bid writing, training and seminars.

Aaron said

I can’t wait to get stuck in and support charities to thrive with their fundraising. Having run a number of charities myself I know how the cost of living, high inflation and increased competition for funding is making it so hard at the moment. Craigmyle’s amazing track record and experienced team of consultants bring an array of skills and knowledge for charities, schools, universities and faith groups to raise the funds they need to make a difference to the people and communities they work with.

To contact Aaron please call him on 07968 442 168 or email at aaron@craigmyle.org.uk

Connect with Aaron on Linked In.

Later this month, Craigmyle will be taking a deep dive into schools fundraising, with week-long relevant and thought-provoking content for Heads, Development Directors, Bursars and Governors.

There will be insight and advice from across our team of experienced consultants, as well as historical context from our archives containing more than 60 years of fundraising with schools and other educational establishments.

We will be looking at various hot topics, from the recent threat to charitable status, to bursaries, and how to create a culture of giving.

Director, Christine Buccella:

Supporting schools to maximise fundraising returns whilst retaining goodwill has been a core aspect of Craigmyle’s work for more than six decades. Throughout the many changes that have been seen, Craigmyle has continued to provide strategic and practical advice and forge lasting and productive partnerships. Today, schools face many challenges and we know fundraising and development remains vital.

Don’t miss out – be sure to follow us and join in the conversation on Linked In.

#craigmyleschoolsweek

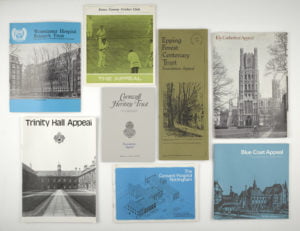

The collection is made up of papers relating to their role in providing advice and guidance to the fundraising sector, their relationships and communication with a wide variety of clients, from ecclesiastical institutions to educational organisations, that the Company has worked with since its creation in 1959, and the governance of the organisation.

To catalogue this collection, and make Craigmyle’s archive more widely accessibly, Special Collections & Archives at the University of Kent appointed a Project Archivist, Dr Daniella Gonzalez.

The collection contains 212 boxes of material that Daniella is currently sorting and initially listing to gain a better understanding of the scope and content of the collection, and to aid planning for how to structure the collection and approach the various stages of this cataloguing project. Interesting files so far have included press cuttings, a huge series of fundraising brochures, leaflets and appeals forms, as well as correspondence files with a wide variety of clients fundraising for new buildings, refurbishments, equipment purchase, staff costs and project work.

Collaboration has already started with colleagues in the Centre for Philanthropy at the University of Kent about potential future research projects that can be developed by studying Craigmyle’s archive. Over the next year, Daniella will fully catalogue the collection and make Craigmyle’s archive available on the Special Collections and Archives’ website. This will provide academic researchers, both at the University and externally, and the general public the opportunity to consult the collection and further understand Craigmyle’s vital contribution to the fundraising and philanthropy sector.

Dr Daniella Gonzalez cataloguing files

The project will complete with an exhibition, showcasing records from across Craigmyle’s archive. This exhibition will celebrate Craigmyle’s success in supporting clients through fundraising, as well as how and why this is a key collection when researching both the history of and current role of philanthropy and fundraising. Daniella will work closely with Siân Newton, Director at Craigmyle, to publicise the exhibition, and an online version of the exhibition will be made available to reach wider audiences.

Dr Daniella Gonzalez, Project Archivist, Special Collections & Archives, University of Kent:

I’m absolutely thrilled to have the opportunity to be working on such a varied collection from an organisation that has played, and continues to play, a key part in the fundraising and philanthropy sector. It’s been really interesting to view the very different clients that Craigmyle has worked with and to see that these same organisations have looked towards Craigmyle over the years for backing in fundraising. It’s a testimony to just how important Craigmyle’s support has been and it’s going to be great to make Craigmyle’s archive available to researchers – academic and non-academic – through this cataloguing project.

Siân Newton, Director, Craigmyle Fundraising Consultants:

We are delighted to be working with the University of Kent to help make the Craigmyle archives more accessible to researchers, fundraisers and the wider public.

The breadth and depth of the archives reflect Craigmyle’s long, successful and diverse history providing fundraising consultancy to all areas of the not-for-profit sector. They can shed fascinating insight into changing trends within fundraising, the voluntary sector and society more generally. They also underline the important role fundraising has in achieving transformative UK charitable projects that meet the challenges faced by society – and that’s as vital now as ever before. Today’s team of accredited consultants are proud to be part of the Craigmyle story.

Craigmyle Fundraising Consultants enables UK charities and not-for-profit organisations to realise their objectives through fundraising by providing expertise tailored to each client that draws upon our consultants’ hands-on experience of strategy and implementation, collective team knowledge and our 60-year+ track record.

Since its foundation by Lord Craigmyle in 1959, Craigmyle’s fundraising consultants have helped more than 2000 charities – encompassing the full breadth of the non-profit sector and including cathedrals, churches, hospitals, hospices, museums, heritage projects, schools, welfare, arts and conservation organisations – raise over a billion pounds for capital and revenue projects.

The National Lottery Heritage Fund has awarded a grant of £250,000 to Christ Church St Leonards for urgent repairs to the to the exterior of the church and an associated heritage community engagement project.

The project will Celebrate Christ Church in the Community by restoring and revitalising this Grade II* listed building at the heart of St Leonards on Sea, and organising a series of learning events and activities open for all the members of the community.

Craigmyle consultant, Christine Buccella, has been working with Christ Church to develop the project and apply to the Lottery. Christine had previously successfully applied for two major grants for Christ Church from the Historic England’s Cultural Recovery Fund for Heritage, totalling £280,000.

This National Heritage Lottery Fund grant will allow Christ Church to complete all of the restoration work to the external façade of the building, leading to its removal from the Heritage at Risk Register. Craigmyle is proud to have helped the church secure a level of funding that has never before been achieved.

Christ Church opened for worship in 1875, with the steeple added in 1895. Today, the spire of Christ Church is an important landmark, rising above the town’s roof-scape. The church works hard to support the local residents, including hosting groups such as AA and CA, and street sleepers during the winter months. It is also active at the heart of the surrounding artistic and civic community, welcoming choirs and musicians, and a variety of classes and groups of all ages including our own Scouts.

The plans will improve the neglected appearance of the building, which will also help to improve the appearance of the high street where it sits. Live demonstrations and interpretation projects focussing on the key heritage assets of the church will accompany a series of seasonal events including regular heritage tours by volunteer guides, a ‘heritage hub’ from which community activities will be developed and run, and a programme to involve local schoolchildren.

Commenting on the award of the Lottery grant, Fr Thomas Crowley, the Priest in Charge at Christ Church said:

We’re delighted that we’ve received this support thanks to National Lottery players. The restored building, and the buzz of engagement around this project, and a celebratory exhibition to display the outputs of our community co-productions, will act as a springboard for the celebrations of our 150th Jubilee in 2025.

Work has already begun on the project, with an anticipated completion date of Summer 2024.

We are pleased to announce that Greg Hodder and Matthew Horton, have joined the Craigmyle consultant team as of January 2023, bringing a wealth of fundraising experience especially in charity and educational sectors.

Greg Hodder

Following 17 years in fundraising, Greg brings extensive experience managing projects and fundraising for capital appeals and annual funds. He has initiated multi-million-pound capital appeals in a range of areas such as hospices and universities. Greg has significant experience working with major donors and has raised multiple six-figure sums. He is also well-versed in large events, trusts and foundations and individual and community giving. He has coached and run training sessions in fundraising skills for students, trustees and key stakeholders.

His degree in Education and English at Cambridge University gave Greg a passion for storytelling. He uses this experience to help charities tell their stories through their case for support and communications in a compelling way.

Greg commented

I am delighted to join Craigmyle which has such an established and successful track record. I look forward to drawing upon my skills and experience to assist a wide range of organisations.

To contact Greg, telephone 07793 225769 or email him at Greg@craigmyle.org.uk

Matthew Horton

Matthew brings over 25 years’ experience of working in fundraising and alumni relations. Holding a range of senior roles in universities and charities, he is accomplished at developing fundraising and donor engagement strategies from scratch or refocusing lapsed programmes. He has significant experience in delivering five and six figure gifts from trusts, corporates and major donors.

In particular, Matthew has a strong track record in developing evidence-based fundraising strategies and operational plans for organisations of different sizes, and establishing fundraising tools which embed fundraising at the core of an organisation.

As Head of Alumni Relations at LSE and Head of Major Giving at the University of Reading, Matthew gained experience of the development and delivery of large capital campaigns, £100m and £150m respectively.

Matthew says

‘I am excited about joining Craigmyle Fundraising Consultants. While charities are facing difficult times, I am looking forward to helping the wider charity and educational communities, backed by Craigmyle’s considerable wealth of experience’.

To contact Matthew, telephone 07540 466828 or email him at Matthew@craigmyle.org.uk

Craigmyle Fundraising Consultants is delighted to announce that we are now in a position to recruit new Fundraising and Development talent to join our team as accredited consultants. For over 60 years, Craigmyle has delivered tailored expertise across all not-for-profit sectors. This is a great opportunity for experienced fundraisers who are ready for a new challenge, working with an established brand, a highly experienced supportive team and central marketing. For Potential Accredited Consultants, please take a look at the Brief.

*

Craigmyle enables UK charities and not-for-profit organisations to realise their objectives through strategic development and fundraising. We offer a range of services, ranging from capital campaigns to social investment advice, feasibility studies to mentoring, and interim management to bid writing.

The team currently consists of nine consultants. Many consultants are sector specialist, but all consultants operate as general practitioners across all sectors. We operate mainly in the following not-for-profit sectors: Education, Heritage, Arts, Faith, Community, Social Investment, Health & Welfare.

Craigmyle accredited consultants are independently trading but exclusively under the Craigmyle brand. Marketing and acquisition is centralised. The team works in a collaborative manner. As well as working together, there is a commitment to ongoing learning, including mentoring, training, team meetings and peer-to-peer reflective practice. Any new consultants will receive a structured induction programme and the ongoing benefit of vastly knowledgeable and experienced colleagues who are happy to share advice and support your professional development.

“The variety and flexibility of work, opportunities to learn, and support of an amazing team make working with Craigmyle an exciting prospect. This is a great time to join, whether you’re ready for a change using your knowledge to help more great causes, you’ve been thinking about becoming a consultant but aren’t sure where to start, or you’re an established consultant who wants to be part of a team.“ Siân Newton, Director

Craigmyle Fundraising Consultants is the longest established fundraising consultancy in the UK. Since 1959, Craigmyle consultants have provided services to more than 2,000 clients, across all areas of the not-for-profit sector, many of them returning for assistance on several assignments.

We enable UK charities and not-for-profit organisations to realise their objectives through strategic development and fundraising by providing expertise tailored to each client that draws upon our consultants’ hands-on experience of strategy and implementation, collective team knowledge and our 60 + year track record.

Our objectives include building strong, long-lasting donor relationships, achieving financial sustainability and developing fundraising capacity for our clients.

Potential Accredited Consultants who are interested in an informal exploratory chat can call Christine on 07914 340325 or email christine@craigmyle.org.uk.

For further information on Craigmyle Fundraising Consultants and the services we offer clients please contact Siân on 07752144565 or sian@craigmyle.org.uk.

The Mini-Budget statement from the new Chancellor, Kwasi Kwarteng, came as the UK continues to face considerable pressures from high inflation and substantial increases in the cost of living. Mr Kwarteng outlined a series of measures he believes will boost economic growth.

Titled a Growth Plan, there were some substantial announcements, with significant associated costs on tax cuts and energy support.

The Growth Plan makes growth the government’s central economic mission, setting a target of reaching a 2.5% trend rate.

On energy, the government has already announced an Energy Price Guarantee (with the average household paying no more than £2,500 per year for 2 years from October 2022). A six-month Energy Relief Scheme will support businesses and other non-domestic energy users, including charities and public sector organisations.

There are a number of significant changes on tax.

The Growth Plan cuts National Insurance contributions from November (reversing the 1.25% rise) and cancels the Health and Social Care Levy and next year’s planned rise in Corporation Tax, keeping it at a rate of 19%.

The Growth Plan brings forward the planned 1p cut to the basic rate of income tax (to 19p) to April 2023. It abolishes the additional rate of income tax (45p for top earners). Charities will need to review the implications of this on the tax-effective giving plans of their higher-earning donors.

Alongside these income tax changes, the government recognises the importance of Gift Aid to charities and is maintaining Gift Aid at the current level until April 2027.

From 23rd September, the threshold from which house-buyers begin to pay Stamp Duty Land Tax will be doubled to £250,000. First-time buyers will pay no stamp duty on homes worth £450,000, up from £300,000 and the maximum value of a property on which first-time buyers’ relief can be claimed will also increase from £500,000 to £625,000.

Addressing the statement in detail, key announcements included:

Energy Bill Relief Scheme – The new six-month Energy Bill Relief Scheme for businesses and other non-domestic energy users, including charities and public sector organisations (such as schools and hospitals), providing them with a discount on energy prices. (Paragraph 2.6). Further details on the scheme can be found here. The government also announced £400 support for households through the Energy Bills Support Scheme. (paragraph 2.3)

Income Tax – The Government will bring forward the 1 percentage point cut to the basic rate of income tax to April 2023, 12 months earlier than planned. This will apply to the basic rate of non-savings, non-dividend income for taxpayers in England, Wales and Northern Ireland; the savings basic rate which applies to savings income for taxpayers across the UK; and the default basic rate which applies to non-savings and non-dividend income of any taxpayer that is not subject to either the main rates or the Scottish rates of income tax. (Paragraph 3.2.1)

The additional rate of income tax will also be removed from April 2023. This will apply to the additional rate of non-savings, non-dividend income for taxpayers in England, Wales and Northern Ireland. The additional rate for savings, dividends and the default rates will also be removed from April 2023, and this change will apply UK-wide. Where rates are devolved in Scotland the Scottish Government will receive funding through the agreed fiscal framework to allocate as they see fit. (Paragraph 3.2.2)

As the additional rate of income tax will be removed current additional rate taxpayers will also benefit from the Personal Savings Allowance of £500 for higher rate taxpayers. (Paragraph 4.2.7). A HMRC factsheet on income tax is available.

Gift Aid transition period – A four-year transition period for Gift Aid relief will apply, to maintain the income tax basic rate relief at 20% until April 2027. This means in practice that charities and CASCs will continue to claim Gift Aid and GASDS at 25p for every £1 of eligible donation made between 6th April 2023 and 5th April 2027. (Paragraph 4.2.7)

Relief at Source transitional period – There will also be one-year transitional period for Relief at Source (RAS) pension schemes to permit them to continue to claim tax relief at 20%. (Paragraph 4.2.7).

National Insurance increase reversed – The 1.25% National Insurance increase introduced in April 2022 is to be reversed from 6 November 2022. (Announced on 22nd September). See HMRC factsheet for further details.

Health and Social Care Levy cancelled – The Health and Social Care Levy due to be introduced in April 2023 will be cancelled through new legislation (paragraph 3.20)

Tax Simplification – The Government has announced that instead of having a separate arms-length body oversee simplification, it will embed tax simplification into the institutions of government. It will therefore abolish the Office of Tax Simplification and set a mandate to the Treasury and HMRC to focus on simplifying the tax code. (paragraph 3.43)

Corporation tax rise cancelled -The government has committed to cancel the increase in the main rate of Corporation Tax to 25% that was due to take effect from April 2023, keeping the rate at 19% (paragraph 3.9).

Repealing off-payroll working reforms – The 2017 and 2021 reforms to the offpayroll working rules (also known as IR35) will be repealed from 6 April 2023. From this date,

workers across the UK providing their services via an intermediary, such as a personal service company, will once again be responsible for determining their employment status and paying the appropriate amount of tax and NICs.(paragraph 4.20)

Stamp Duty Land Tax thresholds increased – From 23 September 2022, the government will increase the threshold above which Stamp Duty Land Tax (SDLT) must be paid on the purchase of residential properties in England and Northern Ireland from £125,000 to £250,000. The government will also increase the relief that first-time buyers can receive. From 23 September 2022, the threshold at which first time buyers begin to pay residential SDLT will increase from £300,000 to £425,000, and the maximum value of a property on which first-time buyers relief can be claimed will also increase, from £500,000 to £625,000. (paragraph 4.24)

New Investment Zones – The Government will work with the devolved administrations and local partners to introduce Investment Zones across the UK. Investment Zones aim to drive growth and unlock housing. Areas with Investment Zones will benefit from tax incentives (including certain business rates reliefs), planning liberalisation, and wider support for the local economy. (paragraph 4.1.2)

Changes to Universal Credit – The government is increasing the Administrative Earnings Threshold to 15 hours a week at National Living Wage for an individual claimant (and 24 hours a week for couples) from January 2023. (paragraph 4.30) The government will be strengthening the sanctions regime to set clear work expectations – including applying for jobs, attending interviews or increasing the hours– in return for receiving Universal Credit. (paragraph 4.31)

HM Treasury document can be seen at this link:

https://www.gov.uk/government/publications/the-growth-plan-2022-documents

Please note: This bulletin is published as a general guide and not intended to replace specific professional advice from, for example, a solicitor or accountant. You should always refer to the official websites shown above for further information. Craigmyle consultants take no responsibility for the correctness or completeness of information or interpretation given here.

It is with great sadness that we have learned of the passing of Her Majesty Queen Elizabeth II.

Her Majesty The Queen was an extraordinary, greatly loved and highly respected figure, not just in the United Kingdom and Commonwealth, but globally. Our longest ruling British monarch, she was renowned throughout her reign for her exceptional leadership, steadfast dedication and service to the United Kingdom and the Commonwealth.

She was a huge supporter of charitable institutions, both in her specific role as Patron of many charities and her more general support of the principle of volunteering and not for profit activity. The Third Sector owes her a huge debt of gratitude for the prominence and weight she gave to charitable activity and we will never forget her outstanding example over more than seven decades.

We express our heartfelt condolences to the Royal Family at this extremely sad time.

Craigmyle Fundraising Consultants today announced that Gill Moody has decided to retire.

Since 1998, Gill has worked as a consultant, helping a range of churches, charities and third sector organisations build sustainable fundraising success.

Over her time, she served as a champion for nurturing new talent, developing partnerships and growing business, particularly in Craigmyle’s ecclesiastical sector.

“Gill has contributed 24 years of experience to Craigmyle and her achievements have been invaluable and will not be forgotten. Gill’s work ethic, command of complexity, commitment and client focus have been exemplary,” said Siân Newton, fellow Director. “Gill has been a mentor to many, including myself, and her influence has made an indelible impact. Everyone wants to thank Gill for all she’s done for the development of Craigmyle. She will be missed.

“For over 60 years, Craigmyle has enabled UK charitable causes to achieve their goals. We look forward to writing the next chapter of this story, and continuing to serve our clients as they respond to the demands of today’s fast-changing funding environment. “

Gill started life as a teacher, then worked for the Church Urban Fund as Campaign Director, as Faith In the City Officer for the Church of England and Charitable Appeals Manager at The Leicester Royal Infirmary NHS Trust.

Craigmyle Fundraising Consultants enables UK charities and not-for-profit organisations to realise their objectives through fundraising by providing expertise tailored to each client that draws upon our consultants’ hands-on experience of strategy and implementation, collective team knowledge and our 60-year track record.

Since its foundation by Lord Craigmyle in 1959, Craigmyle’s fundraising consultants have helped more than 2000 charities – encompassing the full breadth of the non-profit sector and including cathedrals, churches, hospitals, hospices, museums, heritage projects, schools, welfare, arts and conservation organisations – raise over a billion pounds for capital and revenue projects.

Yesterday’s spring economic and fiscal forecast came as the UK faces rising inflation which has been accelerated due to higher than usual uncertainty, following the invasion of Ukraine, and higher than expected global energy and goods prices that have already led to an increase in the cost of living in the UK.

Slightly better than expected UK economic recovery in 2021 (7.5% GDP growth) gave the Chancellor a little leeway to provide assistance. The resulting tax plan – with its focus on helping families with the cost of living, creating the conditions for private sector led growth, and sharing the proceeds of growth fairly with working people – was claimed as the biggest net cut to personal taxes in 25 years.

With the reduction in the basic rate of income tax due from April 2024, charities will be pleased to note the three-year transition period for Gift Aid relief to maintain the income tax basic rate relief at 20% until April 2027.

Despite some calls for a windfall tax, there was no further help with steeply rising energy costs, with the statement claiming that most households will be protected until the autumn by the OFGEM energy price cap.

Although the rising cost of living was a frequent reference, many of the measures focused on workers and homeowners, with limited assistance for those out of work, whether due to job loss, health or disability or retirement. The Resolution Foundation claims more than 1.3 million people will not be able to afford basic necessities next year.

Addressing the statement in detail, the announcements included:

Increasing National Insurance thresholds – The annual National Insurance Primary Threshold and Lower Profits Limit, for employees and the self-employed respectively, will increase from £9,880 to £12,570 from July 2022. (Paragraph 3.6) This aligns NI thresholds with the income tax personal allowance (and these thresholds will remain aligned). (Paragraph 2.11)

Reducing Class 2 NICs payments for low earners – From April, self-employed individuals with profits between the Small Profits Threshold and Lower Profits Limit will not pay class 2 NICs, meaning lower-earning self-employed people can keep more of what they earn while continuing to build up National Insurance credits. Over the year as a whole, the Lower Profits Limit, the threshold below which self-employed people do not pay National Insurance, is equivalent to an annualised threshold of £9,880 between April to June, and £12,570 from July. (Paragraph 3.7)

Increasing the Employment Allowance – The Employment Allowance will increase from April 2022, meaning eligible employers will be able to reduce their employer NIC bills by up to £5,000 per year – a tax cut worth up to £1,000 per employer. As a result, businesses will be able to employ four full-time employees on the National Living Wage without paying any employer NICs. This measure will benefit around 495,000 businesses, including around 50,000 businesses which will be taken out of paying NICs and the Health and Social Care Levy entirely. In total, this means that from April 2022, up to 670,000 businesses will not pay NICs or the Health and Social Care Levy due to the Employment Allowance. (Paragraph 3.8)

Reduction in basic rate of income tax – the basic rate of income tax will be cut to 19% from April 2024. This is a tax cut of over £5 billion a year and represents the first cut in the basic rate of income tax in 16 years. This will apply to the basic rate of non-savings, non-dividend income for taxpayers in England, Wales and Northern Ireland; the savings basic rate which applies to savings income for taxpayers across the UK; and the default basic rate which applies to a very limited category of income taxpayers made up primarily of trustees and non-residents.

The change will be implemented in a future Finance Bill. A three-year transition period for Gift Aid relief will apply, to maintain the income tax basic rate relief at 20% until April 2027. The reduction in the basic rate for non-savings-non-dividend income will not apply for Scottish taxpayers because the power to set these rates is devolved to the Scottish Government. Under the agreed Fiscal Framework, the Scottish Government will receive additional funding, worth around £350 million in 2024-25. It is for the Scottish Government to use this additional funding as they choose, including reductions in income tax or other taxes, or increased spending. (Paragraph 3.9)

Temporary cut to fuel duty – The government will cut the duty on petrol and diesel by 5p per litre for 12 months. This will take effect from 6pm on 23 March on a UK-wide basis. Where practical, a proportionate cut will also apply to fuel duty rates which are lower than the main rates for petrol and diesel, including red diesel. (Paragraph 3.10)

Extending the Household Support Fund – To help households with the cost of essentials such as food, clothing and utilities, the government is providing an additional £500 million for the Household Support Fund from April, on top of the £500 million already provided since October 2021, bringing total funding to £1 billion. In England, the Government says that local authorities are best placed to help those in their areas who need it most. They will receive an additional £421 million, whilst the devolved administrations will receive an additional £79 million in funding through the Barnett Formula. (Paragraph 3.11)

VAT relief for energy saving materials (ESMs) – The Government will reverse a Court of Justice of the European Union ruling that it says restricted the application of VAT relief on the installation of ESMs. This will mean wind and water turbines will be added to the list of ESMs and the complex eligibility conditions will be removed. The Government will also increase the relief further by introducing a time-limited zero rate for the installation of ESMs. The changes will take effect from April 2022. The Northern Ireland Executive will receive a Barnett share of the value of this relief until it can be introduced UK-wide. (Paragraph 3.12)

Green reliefs for Business Rates – At Autumn Budget 2021 the government announced the introduction (in England) of targeted business rate exemptions from 1 April 2023 until 31 March 2035 for eligible plant and machinery used in onsite renewable energy generation and storage, and a 100% relief for eligible low-carbon heat networks with their own rates bill, to support the decarbonisation of non-domestic buildings. The government is bringing forward the implementation of these measures and is announcing that they will now take effect from April 2022. (Paragraph 3.13)

R&D tax relief reform – Following consultation with stakeholders the Government has confirmed that from April 2023, all cloud computing costs associated with R&D, including storage, will qualify for relief. The government says it remains committed to refocus support towards innovation in the UK, ensuring that the UK more effectively captures the benefits of R&D funded by the reliefs. The Government recognises that there are some cases where it is necessary for the R&D to take place overseas. To support the growing volume of R&D underpinned by mathematical advances, the definition of R&D for tax reliefs will be expanded by clarifying that pure mathematics is a qualifying cost. (Paragraph 3.14)

Additional compliance resource for HMRC – The Government is investing £161 million over the next five years to increase compliance and debt management capacity in HMRC. This investment is forecast to bring in more than £3 billion of additional tax revenues over the next five years, by funding additional HMRC staff to provide greater support to taxpayers seeking to pay off accrued tax debts, and to tackle the most complex tax risks, ensuring large and mid-sized businesses pay the tax they owe. (Paragraph 3.15)

Tackling Fraud – The Government is providing £48.8 million of funding over three years to support the creation of a new Public Sector Fraud Authority and enhance counter-fraud work across the British Business Bank and the National Intelligence Service. The investment enables government and enforcement agencies to step up their efforts to reduce fraud and error, bring fraudsters to justice, and will recover millions of pounds. (Paragraph 3.18)

Second Round of Levelling Up Fund – The Government is launching the second round of the Levelling Up Fund and publishes a refreshed Prospectus, inviting bids to come forward from all eligible organisations across the UK. This Fund provides £4.8 billion for local infrastructure projects, with £1.7 billion already allocated to 105 successful projects from the first round. (Paragraph 3.19)

Additional funds for Changing Places Fund – The government previously made £30 million available to local authorities in England to install life-enhancing Changing Places toilets in existing buildings. The Spring Statement is allocating £25.3 million of the Fund to install over 500 life-enhancing Changing Places toilets, in public places and tourist attractions where users want them the most. This will dramatically increase accessibility for thousands of severely disabled people who need specialised facilities. An additional £6.5 million will be allocated to areas where there is little or no provision. (Paragraph 3.20)

Announcement of Tax Plan which contains three key priorities: helping families with the cost of living; cuts and reform of business taxes, to create a new culture of enterprise and the conditions for private sector-led growth; sharing the proceeds of higher growth fairly with working people, through further tax cuts. The government also intends to make the tax system simpler, fairer and more efficient through this plan. (Paragraph 4.5)

HM Treasury document can be seen at this link:

https://www.gov.uk/government/publications/spring-statement-2022-documents

Please note: This bulletin is published as a general guide to the 2022 Spring Statement and not intended to replace specific professional advice from, for example, a solicitor or accountant. You should always refer to the official websites shown above for further information. Craigmyle consultants take no responsibility for the correctness or completeness of information or interpretation given here.

In March 2021, a team of three Craigmyle Consultants was appointed by Pembrokeshire County Council to work with them and other partners in developing a major bid application within Round 1 of the UK Government’s new Levelling Up Fund. The bid focused on the economic regeneration of the historic county town of Haverfordwest via imaginative investment in its heritage and cultural assets.

We were thrilled to learn this week in the Chancellor of the Exchequer’s autumn Budget announcement that this application has been completely successful in all its aspects, and that an award of £17.7m has been made to Pembrokeshire County Council in support of this worthy project. This grant represents the second largest Levelling Up Fund award made within Wales.

The £17.7m provided towards the regeneration of Haverfordwest will support ongoing improvement work at the town centre site of Haverfordwest’s 13th century castle, which has fallen into disuse and increasing dilapidation. The investment will fund the creation of a vibrant outdoor performance space, the renovation of the Victorian gaol within the castle walls in preparation for it housing a flagship visitor attraction, and the creation of a lovely castle walls perimeter walk with associated green infrastructure enhancements.

Additionally, the funding also supports the enhancement of the town centre through the creation of an architecturally stunning ‘signature bridge’ over the River Cleddau, linking key arrival points into the town to a vibrant quayside cultural quarter area, and creating much improved access from the town centre up to the castle’s visitor attractions.

The scheme sits within the Council’s wider regeneration strategy for Pembrokeshire. Cllr Paul Miller, Cabinet Member with responsibility for Economic Development, responded to the fantastic news of the award saying: “My thanks go to all those involved in putting together the formal bids. It’s a great example this, of working together, irrespective of political boundaries, for the benefit of Pembrokeshire… This is a really significant milestone on our regeneration journey.”

Dr Steven Jones, Director of Community Resources at Pembrokeshire County Council added: “The core investment in local landmarks and facilities contributes significantly to the place making, economic development, regeneration and transformation of Pembrokeshire. New town centre facilities are fundamental to increasing footfall in Pembrokeshire towns and promoting community confidence, new growth and prosperity in a post-Covid environment.”

Craigmyle consultant, Dr Joel Burden, said “Our dedicated team of Alison Giles, Siân Newton and I couldn’t be more delighted to hear this wonderful news from the UK Government. The bid was written on a very tight timetable, and being a Round 1 application, there was no existing template for success for us to follow. Drawing on Craigmyle’s long experience in fundraising and working closely with a fantastic set of expert partners at the Council and within the other project consultancy teams, we were able to craft a strong bid for a really worthwhile project. It is gratifying to see this great team effort bear fruit with an award that is going to be transformational for Haverfordwest. We are now looking forward to seeing the project develop on the ground over the next few years.”

Picture credit: © Wici Rhuthun 1

We are delighted that earlier in the year The National Lottery Heritage Fund awarded £10,000 to our client, the Church of the Ascension, Blackheath for a project to explore the church’s heritage and radical traditions through personal and biographical stories from the community, past and present.

From the days of its association with Greyladies College, hosting a pre-WW1 Church Lads Brigade to its pivotal role in the South Bank Religion movement of the 1970s, the Lesbian and Gay Christian Movement and the Movement for the Ordination of Women, alongside community-based initiatives such as the Wash House Youth Club, the con-temporary church continues to provide a focus for worship, prayer, inclusion, social jus-tice, human rights, debate and protest.

Under the title, ‘One roof, many stories: radical and inclusive histories’, the project will engage local volunteers in researching and interpreting a range of stories and images. These will be made accessible through web pages and audio-visual installation in the church itself.

“We are keen to capture this less recorded and comparatively recent history, some of which has been excluded or omitted from official recorded histories,” said Reverend Anne Bennett. “We are particularly keen to record the memories and material archive of individuals in the congregation and the community before they are lost and forgotten. We are inviting all members of the public that have memories linked to the Church of the Ascension and the various movements it has been involved with to kindly share with us their stories and help us to tell them more widely. We’d also like to hear from anyone who would like to become part of the volunteer research and interpretation team.”

Press contact: Bridget Knapper bridget.knapper@ntlworld.com 07876 367142

Notes:

About The Church of the Ascension, Blackheath

The Church of the Ascension, Dartmouth Row, SE10 8AW is a grade II * listed building and one of the oldest churches in Blackheath. The church is both a local parish church hosting groups for young people, ESOL and food poverty. It is also a ‘destination church’ for people in the community, including LGBTQIA+ and others seeking an inclusive and socially aware outlook. It played a pivotal role in the South Bank Religion movement, which sought to reshape Christianity in the light of modern science and the challenges of an unjust world and its members were key figures in the Lesbian and Gay Christian Movement, Amnesty International, Anti-Apartheid and the Movement for the Ordination of Women. It hosts the Amnesty International booksale twice a year.

www.ascension-blackheath.org

@AscensionCurch

About The National Lottery Heritage Fund

Using money raised by the National Lottery, we Inspire, lead and resource the UK’s heritage to create positive and lasting change for people and communities, now and in the future. www.heritagefund.org.uk.

We often emphasise to our clients, large and small, the importance of taking time out from the busyness of everyday to take time to take a strategic approach, review activities and look at longer term planning. While accredited Craigmyle consultants regularly work together in pairs or in threes on projects bringing together the appropriate and different skills and experience required, and seek informal advice and input from all our colleagues, we rarely meet in person and even less during the pandemic.

All being well we will be in Ramsgate this week for our annual get together. All the Craigmyle consultants meet up to discuss the key issues in fundraising and how with over 60 years’ experience we can use current learning to meet today’s challenges. Getting together offers an opportunity to compare experiences and develop a collective picture from our work with clients from across the UK and with different sectors – arts & heritage, faith organisations, educational and charities. Sessions typically draw upon fundraising best practice and theory whilst ensuring a practical side as we explore case studies and how best to use when working with clients.

Last year, our focus was on helping clients adjust to the pandemic and offering immediate support and advice, including keeping supporters informed, thinking holistically and accessing emergency funding.

The focus this year is about looking ahead together and how we can best help our clients move forward. Many clients have had to focus on immediate and short term needs and campaigns and fundraising appeals have been delayed or stalled in the face of the pandemic. As we start to move forward perhaps now is the time to think about longer term planning and the next steps.

If you want to talk with us about how we can help your fundraising planning do get in touch.

If you want to stay in touch with the latest tips and insight arising from our 2021 get together, do follow us on Linked In or Twitter.

We are delighted that the St Alfege Church Heart of Greenwich Place and People project funded by the National Lottery Heritage Fund has been shortlisted for the 2021 Museums and Heritage Show’s Restoration or Conservation Project of the Year Award.

Recognising the care of collections and objects throughout the pandemic has been as important as it ever was, this award highlights the quality of work undertaken on restoration and conservation projects within the UK. This year the Awards received the highest number of entries on record. In assessing projects, the Museum and Heritage Show judges consider how a project has been managed and implemented from conception to completion.

Congratulations to all involved at St Alfege and the Heart of Greenwich project – which aims to reinforce St Alfege’s position as a heritage asset at the heart of Greenwich, reveal and interpret the church’s hidden spaces and heritage for visitors, school children, their families and a diverse local community.

St Alfege Church by Richard BeckThe award ceremony takes place on 1 July.

Find out more about the Museums and Heritage Awards and other shortlisted projects here.

Yesterday, Rishi Sunak announced a budget to extend economic support and promote recovery, in the face of the COVID-19 pandemic, whilst warning of the need to repair the public finances.

There were items that are likely to be of particular interest to cultural organisations, including museums and heritage bodies, and to charities with staff and business premises. There was also a set of more general provisions, such as alterations to corporation tax, that all charities need to note. There was useful confirmation of the position with Inheritance Tax and Social Investment Tax Relief, and development of support for regions, especially as the withdrawal of EU funding takes effect.

Disappointingly, what wasn’t included in the budget was any expansion of the £750m charity support package. There was no temporary increase in Gift Aid, despite calls from the sector. There was also little investment in a green recovery.

Looking at the announcements in detail, firstly there was a raft of measures broadly aimed at protecting jobs and livelihoods. These included:

The Coronavirus Job Retention Scheme was extended by 5 months to September 2021 across the UK, providing employees with 80% of their current salary for hours not worked. Employer contributions will be required from July, initially at 10%, then at 20% from August. (Paragraph 2.14)

The UK wide, Self-Employment Income Support scheme was also extended to September 2021, with 600,000 more people who filed a tax return in 2019-20 now able to claim for the first time. A grant can be claimed from late April to cover February-April (up to a cap of £7,500, worth 80% of 3 months average trading profits); a final grant can be claimed from late July, covering May-Sept, with the grant determined by a turnover test. (Paragraph 2.15 and 2.16)

Income tax exemptions for COVID-19 tests and home office expenses -extended to the 2021-22 tax year. (Paragraph 2.17)

A number of welfare announcements were made (see paragraphs 2.18-2.24) including a six-month extension of the temporary £20 a week increase in Universal Credit allowance and a relaxation in working tax credit hours.

Investments in training and apprenticeships (see paragraphs 2.29-2.31).

Assistance in the form of the Recovery Loan Scheme, a new guarantee for lenders of 80% on eligible loans between £25k and £10m (paragraph 2.42) and Restart Grants offering funding in England for non-essential retail businesses, hospitality, accommodation, leisure, personal care and gym businesses. (Paragraph 2.43)

VAT reduction for the UK’s tourism and hospitality sector – the government will extend the temporary reduced rate of 5% VAT for goods and services supplied by the tourism and hospitality sector until 30 September 2021. A 12.5% rate will apply for the subsequent six months until 31 March 2022. (Paragraph 2.46)

Business rates – the government will continue to provide eligible retail, hospitality and leisure properties in England with 100% business rates relief from 1 April 2021 to 30 June 2021. This will be followed by 66% business rates relief for the period from 1 July 2021 to 31 March 2022, capped at £2 million per business for properties that were required to be closed on 5 January 2021, or £105,000 per business for other eligible properties. (Paragraph 2.47)

Contactless payment card limit – single contactless payments up to £100, and cumulative contactless payments up to £300, will be permitted without requiring the use of chip and pin. (Paragraph 2.54)

The Chancellor announced funding for a number of sectors:

- £475k funding for Armed Forces charities to support digital and data strategies (Paragraph 2.37)

- £10 million to support veterans’ mental health needs across the UK (Paragraph 2.38)

- £19 million to tackle domestic abuse in England and Wales, with funding for a network of ‘Respite Rooms’ to support homeless women and a programme to prevent reoffending. (Paragraph 2.39)

- The Zoo Animals Fund will be extended another 3 months, to end of June 2021.

- £300m extension to the Culture Recovery Fund to support key national and local cultural organisations. (Paragraph 2.56)

- £90 million funding to support government-sponsored national museums in England due to the financial impact of Covid-19. (Paragraph 2.57)

- £300 million for major spectator sports, supporting clubs and governing bodies in England as fans begin to return to stadia. (Paragraph 2.59)

Tax allowances and rates

Inheritance tax nil-rate bands will remain at existing levels until April 2026. The nil-rate band will continue at £325,000; the residence nil-rate band will continue at £175,000, and the residence nil-rate band taper will continue to start at £2 million. Qualifying estates can continue to pass on up to £500,000 and the qualifying estate of a surviving spouse or civil partner can continue to pass on up to £1 million without an inheritance tax liability. (Paragraph 2.73)

Income Tax and NICs – income tax Personal Allowance and income tax higher rate threshold will rise as planned (to £12,750 and £50,270 respectively) from April 2021 and will remain at this level until April 2026. (Paragraph 2.74) The same will apply to NICs thresholds. (Paragraph 2.75)

Corporation tax – to balance the need to raise revenue with the objective of having an internationally competitive tax system, the rate of corporation tax will increase from April 2023 to 25% on profits over £250,000. The rate for small profits under £50,000 will remain at 19% and there will be relief for businesses with profits under £250,000 so that they pay less than the main rate. The Diverted Profits Tax rate will rise to 31% from April 2023 so that it remains an effective deterrent against diverting profits out of the UK. (Paragraph 2.81)

VAT registration threshold: will remain at £85,000 until 2024. (Paragraph 2.91)

Review of tax administration for large businesses – discussions will be initiated with businesses, advisers and stakeholders over the coming months considering improvements as HMRC continues to progress its 10-year Tax Administration Strategy and wider Tax Administration Framework Review. (Paragraph 2.92)

Targeted funds were announced, to spread invest across every part of the UK including:

- £4.8m Levelling Up Fund prospectus launch (investing in infrastructure that improves everyday life across the UK, including town centre and high street regeneration, local transport projects, and cultural and heritage assets.) Priority places have been identified based on an index of local need. See paragraph 2.119.

- £220m UK Community Renewal Fund prospectus launch to support UK communities in 2021-22 to pilot programmes/new approaches as the government moves away from the EU Structural Funds model and towards the UK Shared Prosperity Fund. Funding will be allocated competitively. Priority places have been identified based on an index of local need. See paragraph 2.123

- £150m Community Ownership Fund – from the summer, community groups will be able to bid for up to £250,000 matched funding to help them to buy local assets (like pubs, sports clubs, theatres and post office buildings) to run as community-owned businesses. In exceptional cases up to £1 million of matched funding will be available to help establish a community-owned sports club or buy a sports ground at risk of loss from the community (Paragraph 2.124)

Social Investment Tax Relief extension – the government will continue to support social enterprises in the UK that are seeking growth investment by extending the scheme to April 2023. (Paragraph 2.148)

R&D tax reliefs – the government will carry out a review of R&D tax reliefs, with a consultation published alongside the Budget. (Paragraph 2.149)

HM Treasury document can be seen at this link:

https://www.gov.uk/government/publications/budget-2021-documents

Please note: This bulletin is published as a general guide to the 2021 Spring Budget and not intended to replace specific professional advice from, for example, a solicitor or accountant. You should always refer to the official websites shown above for further information. Craigmyle consultants take no responsibility for the correctness or completeness of information or interpretation given here.

2020 has been challenging, to say the least. The pandemic was largely unforeseen and massively disruptive and we are in an economic recession that is rapidly gathering pace. Other events too have crystallized critical issues ranging from climate change to Black Lives Matter.

Like many businesses, many arts and heritage organisations and charities need to make major adjustments and have business development plans that require a major overhaul to meet the challenges 2020 has thrown up. In recognition of this, Craigmyle has launched a practical recovery service to help arts, cultural and heritage organisations review their strategic plans and fundraising issues effectively and efficiently.

Drawing upon decades of experience, as well as more recent multi-sector fundraising consultancy work, our new two-day service provides a dedicated consultant with sector experience to work with organisations grappling with crucial issues such as:

• How to deal with the gap in earned income, this year and as anticipated in the next few years?

• How to cope, if the audience numbers they can reach in person are smaller?

• How to build loyalty and support in an audience that may be meeting them digitally, rather than in their venue?

• How to remain relevant and address current issues.

Organisations may be focused on immediate survival. Others may have accessed the Government’s Culture Recovery Programme but also need to keep an eye on the bigger picture to achieve longer-term aspirations. We have developed our new service to specifically help organisations review and address these issues urgently and help organisations come up with a clear strategic plan along with recommendations for the future.

Siân Newton, Craigmyle director said:

“We provide a focused and time-limited strategic planning resource for organisations, involving staff and volunteers. Our written report includes an analysis of strategic opportunities, recommendations and an outline of priority actions required in the light of an organisation’s capacity to fulfil them. Now is the time to start working on the way forward.“

Our service is designed to be completed in only two days giving a clear strategic plan with a manageable price tag.

For further information see here or please call 01582 762441 or email first@craigmyle.org.uk.

We are delighted to announce that Gijs Elsen has joined the Craigmyle team as of 1st August.

Gijs brings a wealth of experience in the Performing Arts sector having worked in different areas of the music industry for close to 30 years.

As General Manager of The Sixteen he was responsible for initiating the Choral Pilgrimage, a highly successful annual programme that survives to this day. During 10 years at The Barbican, Gijs brought the greatest international groups, orchestras, artists and ensembles to London and co-produced with major international venues and festivals in projects ranging from classical and contemporary music to opera, film and dance.

Most recently, as Chief Executive of The English Concert Gijs achieved considerable commercial and fundraising success through cross-artform collaborations with opera dance and theatre companies. Through a combination of Arts Council, Trusts & Foundations, corporate sponsorship and Individual Giving he raised more than £3 million in contributed income towards core business, artistic projects as well as education work.

As a Craigmyle Consultant, Gijs will contribute to supporting clients in the following areas:

- Strategic consultancy, including organisational restructuring post-Covid-19

- Fundraising strategy and implementation, including building resilience and project campaigns

- Leadership, Governance and mentoring.

With arts organisations facing unprecedented challenges at this time, Gijs is able to offer a valuable mix of practical advice, change management and expertise honed from decades of work with a broad range of stakeholders. He also brings a sympathetic and supportive ear – something all too often hard to find for arts leaders, especially in small-medium organisations.

Gijs says:

I’m looking forward to working with my new colleagues at Craigmyle, adding my Performing Arts experience to the significant range of skills and disciplines already there. With Craigmyle’s impressive 60-year history I am proud to be part of the team and look forward to working for the benefit of our clients, especially at a time when our support is so very much needed.

To contact Gijs for an informal discussion of how he might support your organisation, telephone 07887 475190 or email gijs@craigmyle.org.uk

St Peter and St Paul, Coleshill, Warwickshire have completed the third of four phases to transform their Grade 1 listed building.

Craigmyle Consultant Dr Joel Burden has been working with Reverend Nick Parker and the Coleshill team to support the church’s fundraising efforts.

Reverend Nick Parker said:

Craigmyle’s advice and support has been absolutely critical to us obtaining the necessary funding to transform our building. They’ve helped us tackle this fundraising in logical phases which has enabled the completion of £650,000 of works in four years. During that time our consultant has become an integral and trusted part of the project team, indeed we’ve felt from the outset that they are personally and professionally committed to the fulfilment of our vision.

Our Grade 1 listed building is duly transformed in terms of its new facilities and we are opening up our heritage to new audiences. Over time we expect local community usage of the church to grow considerably and we will be welcoming many more visitors to this special place. Having gained enormously in confidence, the church community is now looking forward to fundraising for the final phase of this worthwhile project. I heartily recommend Craigmyle’s services to other churches and organisations who are thinking of embarking on similar sorts of campaigns.

This video has recently been made by Coleshill, featuring Reverend Nick Parker, to introduce people to the church and its heritage.

Find out more about Craigmyle’s work with Churches

Craigmyle Consultants’ new client, St Andrew’s Club, is delivering an exciting new online service to meet the needs of young people during the Covid-19 lockdown.

#VirtualAndrews service is supporting Club members’ physical and mental wellbeing through virtual challenges, opportunities for online hangouts and staying in contact with members to help alleviate social isolation and encourage good mental health. St Andrew’s have built a wide range of content, including art, cookery and sport activities inspired by their normal services. To do so, they’ve had to train staff in new skills and develop social media monitoring to track engagement and impact, and enable reporting to donors.

During lockdown St Andrew’s has also provided physical activity packs to support members and their families/carers. The Club, which has been enriching the lives of young people in Westminster for 150 years, is also preparing to deliver their Summer Holiday Programme, adhering to distancing and hygiene guidelines.

For more information go to https://www.standrewsclub.com/index.php/being-club-member/virtual-andrews

At the Grade 1 listed parish church of St Peter and St Paul, Coleshill, contractors are on site for the latest and most complex phase of an ongoing programme of works.

A £1 million re-ordering and restoration campaign has already delivered vital weatherproofing and repair works to the exterior roofs and masonry of this large Warwickshire church, as well as funded the conservation of a nationally significant set of medieval and early modern church monuments.

The building’s facilities have also been significantly upgraded with the creation of disabled toilet provision and a kitchen, which in turn has ushered in the launch of a community café run on site in partnership with a local school. The latest works that are underway will introduce a new heating system in replacement of the church’s antiquated Victorian pipework system and create increased flexibility within the building through the partial removal of pews.

As churches increasingly broaden their community-focused provision, the ability to offer a warm welcome and flexible usage are common concerns within historic buildings that were not originally designed to hold heat efficiently. At Coleshill, a zoned-heating system is being installed which will allow the building to be warmed in relation to specific usages while reducing carbon imprint and running costs.

Campaign Director and Craigmyle Consultant, Dr Joel Burden, who has a background as an historian, commented,

One of the many fascinations of working with old buildings is discovering how earlier generations tackled issues which still confront their custodians today. At St Peter and St Paul, for example, it is still possible to see where coal would have been delivered to the boiler room for the solid fuel stoves of the past, while records still survive from the early 1900s that relate to fundraising for the heating of the chorister’s seats in the chancel.

Craigmyle Consultants have been working with the PCC since a capital campaign was first launched in 2016, with over 90% of the overall project funding has now been pledged.

Avoid hasty decisions and think holistically, across fundraising, marketing and communications. Develop a charity-wide response.

Look after your staff and volunteers. All decisions must have this as the primary consideration.

Keep funders informed and if you need to change/delay your plans for their grant, check it with them first. You’re likely to find them sympathetic and they’ll be pleased that you are being proactive.

Fundraising events or collections are likely to be impacted by social distancing advice. For cancelled activities, be clear and proactive. Are you postponing or cancelling? For ticketed events, will you be returning ticket payments? If those coming are supporters, could you ask them to consider converting it into a donation? If so, then Gift Aid will apply. You may also find that some may give an extra donation on top. They will be sympathetic to your difficulties.

Keep communicating with supporters. They are your supporters and part of the team trying to get the charity through this difficult time. So many will respond to a sensitively worded appeal. If your charity is responding to meet new needs of those affected by coronavirus, then how best can you share this with supporters?

Share images or good news. If you really feel that with so much economic pressure, it isn’t appropriate to seek funds from individuals, there is an opportunity, in these uncertain times, to share images or good news about your organisation and its work with people who share your values.

Be pragmatic: some donors may shift their support in the short term to help projects they wouldn’t normally fund. In the longer term the amount of funding available from trusts and foundations is likely to be less, with the economic impact on investments.

Use the next few months for detailed planning. So often busy charities feel they don’t have time to reflect and plan. Income will be down, so readjust your forecasts and look for ways of minimising risk in the short term, and for new opportunities, medium and long term.

Be creative: you may not be able to meet in person, but you could arrange video calls to keep your project alive (but make sure you test the technology first).

Resist advice to ‘shelve’ projects entirely, wherever possible. You may need to move things onto the ‘slow burner’ but once a project or campaign gets pulled completely, it rarely gets off the ground again.

Readjust your focus: if your project has to go ahead, focus on laying the foundations for fundraising, including preparing your case for support and strategic development. Trust research and bid writing can also be done from home.

Presenting his first budget yesterday, Rishi Sunak, the new Chancellor of the Exchequer, announced a £30bn stimulus package to help the economy get through the coronavirus outbreak. Measures include:

- a £5bn emergency response fund to support the NHS;

- statutory sick pay (SSP) from the first day of absence for those advised to self-isolate or caring for someone who is in self-isolation;

- support through the welfare system for those who cannot claim SSP; through a “new style” Employment and Support Allowance; advance payments on Universal Credit, without having to attend a job centre, for those directly affected by Covid-19; temporary relaxation of the minimum income floor requirements for Universal Credit, for those affected by the virus;

- a £500m hardship fund “to support economically vulnerable people and households in their local area. The government expects most of this funding to be used to provide more council tax relief, either through existing Local Council Tax Support schemes, or through complementary reliefs.”

All these reliefs depend on the person affected following “Government Advice.” Further detail can be found in paragraphs 1.93-1.97 of the budget statement.

There was however no recognition of the potential financial impact on charities which may have to curtail fundraising events or face to face collections or face increased demand from vulnerable clients.

The NCVO has provided helpful guidance for charities in relation to Covid-19 here: https://www.ncvo.org.uk/practical-support/information/coronavirus

Further significant spending was announced with £175m on public infrastructure.

The roll out of Universal Credit has been pushed back to September 2024, along with a number of changes, including:

- extending the time to pay back advance payments to two years;

- reducing the level of debt that can be collected from awards – from 30 to 25 per cent;

- cutting the longest sanction, which is three years;

- delaying surplus earnings threshold reduction by one year;

- additional support for claimants transferring to pension credit;

- changes to severe disability premium regulations.

A range of other measures, including ending the benefit freeze and increasing working age benefits by 1.7% from April 2020, were announced to support to the most vulnerable – see paragraphs 1.180 -1.88.

Disappointingly, there was very little direct mention of charities in the budget at a time when they face financial uncertainty but are being asked to meet growing needs. The work of civil society, and its potential contribution to the government’s aims to ‘level up’ society, appear to have been only scantily recognised.

The Chancellor did, however, announce funding for veterans’, homelessness and environmental projects.

Armed Forces Covenant Fund Trust

The government will provide a £10 million increase in 2020-21 to the Armed Forces Covenant Fund Trust to fund activities that support veterans with mental health needs.

Funding for homelessness

£650m to help rough sleepers into permanent accommodation, with a new stamp duty surcharge for non-UK residents to help fund this.

Nature for climate fund

The government will provide £640m to protect natural habitats, including 30,000 hectares of new trees.

Other announcements, which will may be of interest to charities of various kinds, across different sectors, are summarised below.

Reading tax abolished

From December VAT will be abolished on digital publications which is welcome news since charities use such publications to tell the public and supporters about their work. The government will be consulting on the details of the legislation ahead of its implementation.

Abolition of tampon tax

5% VAT on women’s sanitary products to be abolished from January 2021. Campaigners have welcomed the tax’s removal, but have urged the government to continue to fund charities working with vulnerable women and girls once it has been abolished.

Retail Discount

To support small businesses affected by the coronavirus the government is increasing the Business Rates Retail Discount further to 100% (up from 50%) for 2020-21. This will be expanded to the leisure and hospitality sectors. The extension of retail discount should help charity shops. At present, the relief is subject to State Aid de minimis thresholds however, so an increase in relief could lead to some charities to deplete their allowance.

Review of business rates

A fundamental review of business rates (in England) will take place later this year; some charities may benefit from support to be provided to reduce the overall burden on businesses.

Increased National Insurance threshold

From April, the thresholds at which employees and the self-employed start paying National Insurance contributions will rise from £8,632 to £9,500 – saving employees just over £100 a year

Employment Allowance

From April 2020, the Employment Allowance will be increased from £3,000 to £4,000, which will help many charities but is likely to exclude larger charity employers, only applying to employers with secondary Class 1 NIC liabilities of less than £100,000 in the previous tax year.

Capital Gains Tax Reduction in the Entrepreneurs’ Relief lifetime limit

From March, the lifetime limit on gains eligible for Entrepreneurs’ Relief (which offers a reduced 10% rate of Capital Gains Tax on qualifying disposals) will be reduced from £10 million to £1 million.

Corporation tax rate

The current tax rate of 19% will be retained.

UK Shared Prosperity Fund

Replacing the EU structural funds, the UKSPF will match domestic priorities, with a focus on investing in people. At a minimum, it will match current levels of funding. Further details will be announced in the Autumn Spending Review.

HM Treasury document can be seen at this link:

https://www.gov.uk/government/publications/budget-2020-documents/budget-2020

Please note: This bulletin is published as a general guide to the 2020 Spring Budget and not intended to replace specific professional advice from, for example, a solicitor or accountant. You should always refer to the official websites shown above for further information. Craigmyle consultants take no responsibility for the correctness or completeness of information or interpretation given here.

A new report – Missing Out: Understanding the female leadership gap in fundraising – has been published by the Institute of Fundraising.

It follows 2019 research that found that the majority of senior fundraising roles are held by men, despite the profession being predominantly made up of women.

70% of Institute of Fundraising membership is female.

This predominance of women in fundraising roles hasn’t always been the case. Over its 6 decades, Craigmyle has seen a shift from male fundraising consultants (with female secretaries) to the situation today where female consultants outnumber their male peers by a ratio of two to one, and Craigmyle Directors are 50:50 male and female.